Running a small business is like running a household — you need house rules, clear expectations, and a system that works even when you’re not there to enforce it. HR requirements for small business owners are your company’s “house rules” and they’re not just red tape from the government.

They’re the guardrails that protect your business, your people, and your peace of mind.

When I work with small business owners, I often hear, “I’m too small for HR to matter.” But the truth is, HR matters from the moment you hire your first employee. If you wait until there’s a problem, you’re already behind — and sometimes, already at risk.

This guide walks you through the nine areas that matter most, the ones competitors and regulators are paying attention to, and how to start protecting your business today.

1. Know Which Laws Apply to Your Size

HR compliance is not “one size fits all.” Certain laws kick in only when you reach specific employee counts. For example:

- From day one (1+ employees): You must verify employment eligibility (I-9), follow wage/hour laws, and meet OSHA’s basic safety requirements.

- At 15+ employees: You’re covered by Title VII (anti-discrimination laws) and the ADA.

- At 20+ employees: COBRA rules for health insurance continuation apply.

- At 50+ employees: FMLA and ACA employer mandates come into play.

- At 100+ employees: You must file annual EEO-1 reports.

Why this matters: I once worked with a client who crossed the 15-employee mark and didn’t realize anti-discrimination posting requirements had changed. That simple oversight triggered a state labor complaint they could have easily avoided.

2. Keep Your “House Rules” Up to Date

Your employee handbook isn’t just paperwork — it’s your playbook. It sets expectations, keeps everyone on the same page, and protects you if something goes wrong.

It should cover: how people get paid, time off rules, safety protocols, workplace conduct, and what happens if someone breaks the rules.

But here’s the kicker: a handbook is a living document.

Why this matters: I reviewed a handbook for a business in 2024 that still had a “mandatory unpaid lunch break” policy — illegal under new state law. One update could have saved them thousands in back pay.

3. Recordkeeping Isn’t Busywork — It’s Protection

When there’s a dispute, your best defense is your documentation. This means:

- Employment applications and resumes

- Tax forms (I-9, W-4, state equivalents)

- Signed handbook acknowledgments

- Performance reviews and disciplinary notes

- Medical or accommodation files stored separately and securely

Why this matters: In a wrongful termination claim I consulted on, the employer’s detailed attendance records made the difference between paying a settlement and winning the case.

4. Classify People Correctly — Or Pay Later

It’s tempting to call someone a contractor to “keep things simple.” But if they act like an employee, the law will treat them like one — and you could owe back taxes, overtime, and benefits.

Quick rule:

- Employees: You control their work schedule, location, and methods.

- Contractors: They set their own schedule, work for multiple clients, and bring their own tools.

Why this matters: Misclassification is one of the most common — and costly — mistakes small businesses make.

5. Watch Out for the “Easy to Miss” Rules

Some requirements don’t get talked about as much but can still land you in trouble:

- Labor law posters displayed where employees can see them

- Final paycheck rules (in some states, it’s due the same day employment ends)

- Sending COBRA notices when health coverage ends

- Keeping medical records separate from personnel files

- Industry-specific annual safety training

Why this matters: These are often the first things checked in an HR audit — and the easiest to fix before they become a problem.

6. Safety Isn’t Optional — Even in Small Teams

Even with one employee, you’re responsible for creating a safe work environment. That means:

- Posting emergency procedures

- Stocking first aid kits

- Reporting and documenting workplace incidents

- Training for any hazardous tasks

Why this matters: A minor injury without proper documentation can quickly turn into a workers’ comp nightmare.

7. Train Them Once So They Can Do It Forever

Onboarding is more than a tour and a stack of forms. It’s where you teach employees not just how to do their jobs, but how to succeed in your company.

Good onboarding covers:

- Your policies and culture

- Job tools and expectations

- Compliance basics like safety and harassment prevention

Why this matters: Well-trained employees make fewer mistakes, stay longer, and help you grow without constant oversight.

8. Plan for Problems Before They Happen

Conflict, complaints, and even terminations are part of running a business. The difference between chaos and calm is having a plan:

- Decide how employees can raise concerns — in person, in writing, even anonymously.

- Investigate thoroughly and document every step.

- Apply policies consistently — no favorites, no exceptions.

Why this matters: Inconsistent discipline is one of the fastest ways to end up in court.

9. Your First HR Setup — Step by Step

If you’re starting from scratch, here’s the order I recommend:

- Figure out your legal requirements based on your size and location.

- Write your core policies — even a simple handbook is better than nothing.

- Set up secure systems for payroll and recordkeeping.

- Train your team so they know what’s expected.

- Review every year — laws change, and so will your business.

Don’t Wait for a Problem to Check Your HR

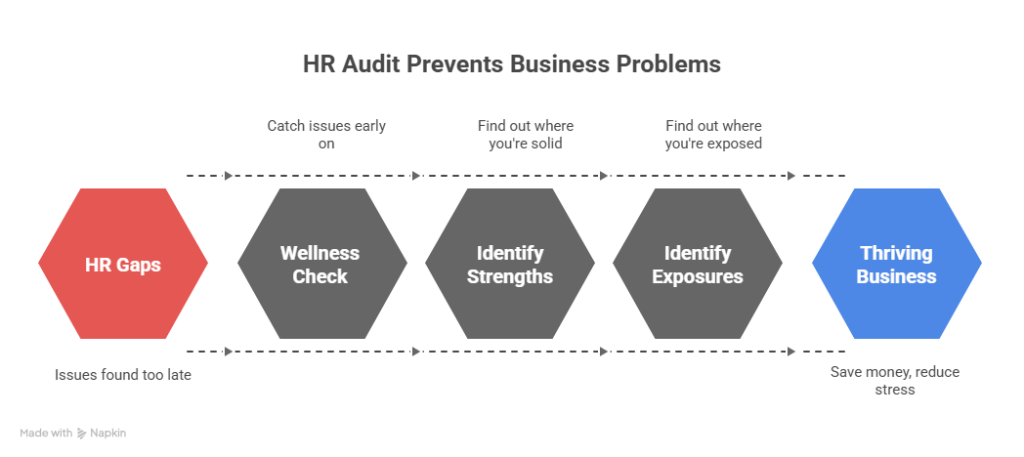

Most small business owners don’t find their HR gaps until it’s too late. An HR audit is like a wellness check — it catches the little issues before they turn into big, expensive problems.

Audit Proof Your Minority Business Here — and find out exactly where you’re solid, and where you’re exposed.

Final Word from HR MOM:

When HR is built into your business early, you save money, reduce stress, and create a space where your people can thrive. And just like in parenting, structure doesn’t limit freedom — it makes it possible.

0 Comments